Everyone’s Getting Rich but You. Here’s Why That’s a Lie

Why most investors lose money chasing meme stocks

Meme stocks are here to stay. There is no way to stop this from happening, and I fear this craze will continue to upend markets, cause uncertainty, and make business fundamentals a thing of the past.

Today, we will talk about Kohls, meme stocks, why they happen, and what you should do about it.

Why Do Meme Stocks Happen?

In almost every case, meme stocks are a byproduct of retail investors revolting against institutional investors. Here’s how it works

Groups of individual investors (we call them retail) get together in online chat rooms and Reddit groups, most notably /r/wallstreetbets. These groups find short sale positions in public markets and rally together to bet against the short.

Short sales are when people are betting that a stock will go down. Retailers find these positions, come together, and invest in the stocks to drive the price up, which punishes the institutions holding the short positions.

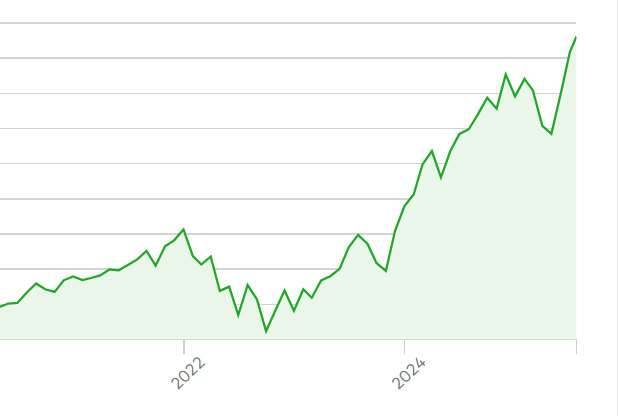

For context, here is Kohls' stock price over the last month.

It’s absurd. There is no reason for Kohls to have such a surge in valuation other than retailers pumping the stock in unison.

Why Is This Happening?

As I said before, retail investors are working as a unit. But in my view, this is bigger than a group of people finding an opportunity to stick it to the man.

Social media has created a new phenomenon in investing. Spend just a few minutes online and you’ll quickly feel like “everyone is rich except for me.” This FOMO, or rather this constant self comparison, is the emotional driver behind meme stocks. Ironically, this fear leads retailers to make bad decisions, which often causes them to lose money.

There is no such thing as timing the market.

The democratization of finance is a good thing. Now, individual people like you and I are mostly privy to the same information that private institutions have, which leads us to believe we have just as good a shot at making money day trading as the institutions do.

But here’s the thing. Institutional investors don’t make money either. On a long enough timeline, most hedge fund managers underperform the S&P 500.

So the entire thing is a giant sham. Yet fear and FOMO are powerful forces, and it is this fear that continues to ignite the meme stock flame. That same flame is lighting retail investors’ money on fire.

How To Make Money Investing

It’s simple.

Buy great companies, and hold them for a long time.

The reason Warren Buffett should be (if not for his charitable donations) the richest man in the world is because he understood the simple fact that to make money, you don’t need to be smart. You just need time.

Time is your friend. Speed is your enemy.

Below is an actual screenshot of my stock portfolio. I’ve never done a day trade in my life, and I’ve drastically outperformed all of my “investor” friends.

In summary, don’t be an idiot.

You will never make money trying to time the market or trying to make a come up off some intel you think you have. Even if you do somehow make money on a trade, the repeated behavior of day trading will inevitably put you back in the red.

It’s a statistical certainty.

Love you guys. Talk to you tomorrow.

Tim

Use This Growth Hack To Grow And Marketing Your Company

I used to think that having a fancy website and an established brand is one of the most important assets in growing your company. Now, I believe that the content and your underlying message is by far the most important, and everything else is a biproduct of your content.

Watch this video to help you get started.

Enjoy!

Learn How To Build a Profitable Internet Business

Join the Agency Clarity Launchpad. The fastest way to $20,000 a month.

In the launchpad, I will teach you how to …

build local Google Business Profiles so that they generate phone calls and new business

create a powerful newsletter that expands your reach, grows your network, and generates additional revenue at scale

build powerful web directories that will help you build yourself as an authority in your space, giving you leverage over the industry and generate leads for your own companies

get new leads, and close deals from local business owners who NEED your services

scale to $20,000 a month while maintaining a high profit margin

This is a no fluff / no BS program. If you want to build your own company, a local GMB agency is the best place to start. You in?

Start building your future today. Click here to join The Launchpad before the price goes up!